Property Taxes For Napa County . The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. Napa county is rank 32nd out of. property tax online payments. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. Simply type in the exact. interested in a napa county, ca property tax search? to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). Access tax information for any napa county, ca home. the process of determining your property taxes involves the efforts of three county offices: The county assessor, the county.

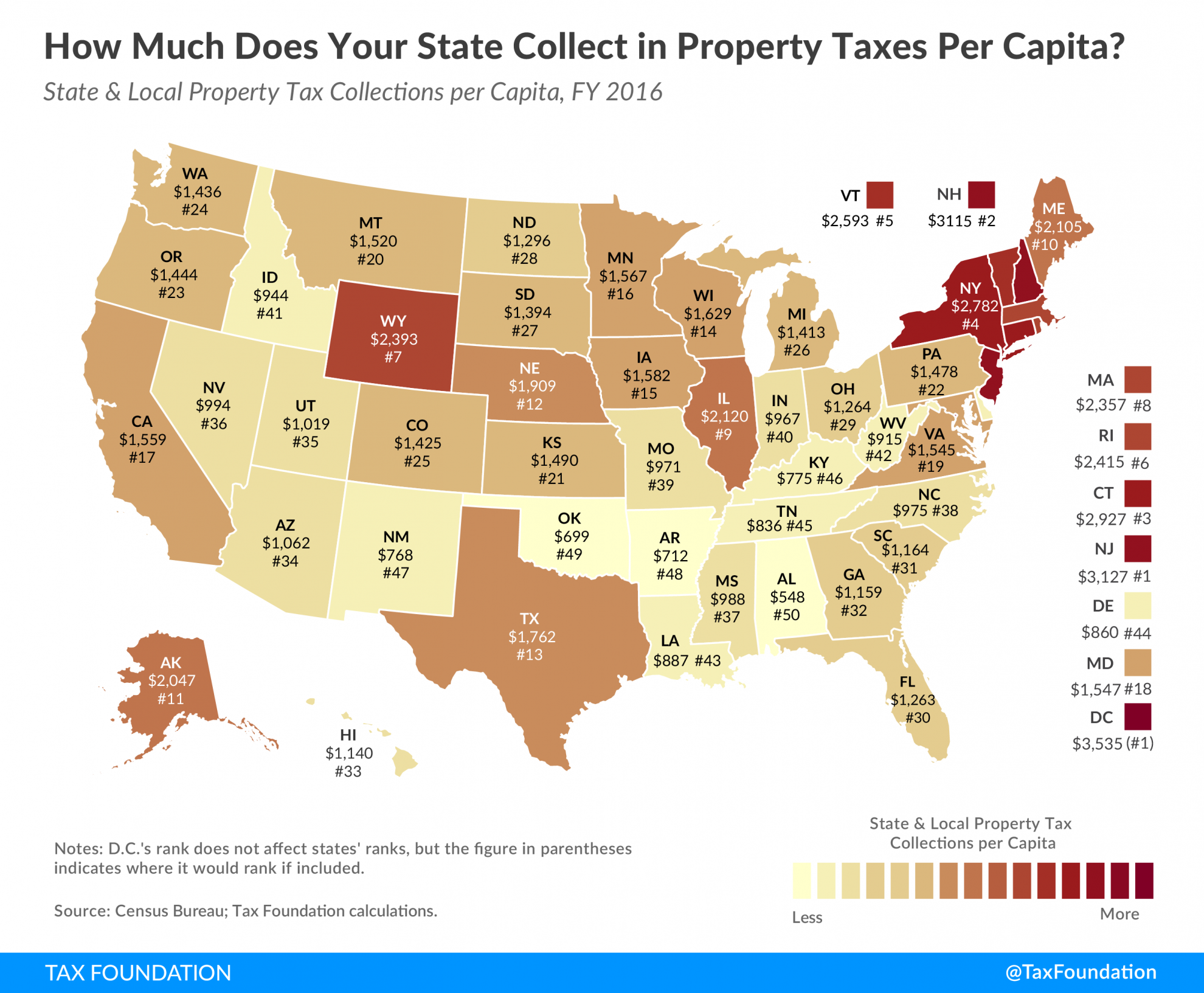

from taxfoundation.org

our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. Access tax information for any napa county, ca home. Simply type in the exact. interested in a napa county, ca property tax search? Napa county is rank 32nd out of. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. The county assessor, the county.

Property Taxes Per Capita State and Local Property Tax Collections

Property Taxes For Napa County Access tax information for any napa county, ca home. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. property tax online payments. Access tax information for any napa county, ca home. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Simply type in the exact. Napa county is rank 32nd out of. to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. the process of determining your property taxes involves the efforts of three county offices: interested in a napa county, ca property tax search? The county assessor, the county. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%).

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Taxes For Napa County Simply type in the exact. The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. The county assessor, the county. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To view a summary of all current or delinquent. Property Taxes For Napa County.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Taxes For Napa County Access tax information for any napa county, ca home. Napa county is rank 32nd out of. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. napa county. Property Taxes For Napa County.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Taxes For Napa County Access tax information for any napa county, ca home. property tax online payments. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. our napa county property tax calculator can estimate your property taxes based on. Property Taxes For Napa County.

From everytexan.org

Who Pays Texas Taxes? (2023) Every Texan Property Taxes For Napa County the process of determining your property taxes involves the efforts of three county offices: our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. interested in a napa county, ca property tax search? The county assessor, the county. property tax online payments. The median property tax. Property Taxes For Napa County.

From www.realtor.com

Napa, CA Real Estate Napa Homes for Sale Property Taxes For Napa County To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. The county assessor, the county. Napa county is rank 32nd out of. property tax online payments. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). to access your property tax information, only enter one search. Property Taxes For Napa County.

From patch.com

May 19 Proposition 19 inar How to Save on Your Property Taxes Property Taxes For Napa County the process of determining your property taxes involves the efforts of three county offices: Napa county is rank 32nd out of. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The county assessor, the county. To view a summary of all current or delinquent fiscal year assessments. Property Taxes For Napa County.

From apeopleschoice.com

How To File Probate In Napa County Property Taxes For Napa County interested in a napa county, ca property tax search? The county assessor, the county. Access tax information for any napa county, ca home. Napa county is rank 32nd out of. the process of determining your property taxes involves the efforts of three county offices: to access your property tax information, only enter one search criteria in the. Property Taxes For Napa County.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Taxes For Napa County our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The county assessor, the county. Access tax information for any napa county, ca home. Napa county is rank 32nd out of. interested in a napa county, ca property tax search? the process of determining your property taxes. Property Taxes For Napa County.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Taxes For Napa County property tax online payments. Napa county is rank 32nd out of. Access tax information for any napa county, ca home. to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. interested in a napa county, ca property tax search? To view a summary of all current or delinquent. Property Taxes For Napa County.

From napavalleyregister.com

NapaStat 3,123 That's the average tax refund for Napa County residents. Property Taxes For Napa County napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). property tax online payments. The county assessor, the county. the process of determining your property taxes involves the efforts of three county offices: interested in a napa county, ca property tax search? The median property tax (also known as real estate. Property Taxes For Napa County.

From mooregrouprealestate.com

Napa County Real Estate November 2018 Report Property Taxes For Napa County The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. The county assessor, the county. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Simply type in the exact. Napa county is rank 32nd out of. interested. Property Taxes For Napa County.

From www.integrityallstars.com

2022’s Property Taxes by State Integrity All Stars Property Taxes For Napa County To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. Access tax information for any napa county, ca home. interested in a napa county, ca property tax search? The median property tax (also known as real estate tax) in napa county is $3,342.00 per year, based on a. the process of determining. Property Taxes For Napa County.

From www.mof.gov.sg

MOF Press Releases Property Taxes For Napa County To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. The county assessor, the county. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you. Property Taxes For Napa County.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Taxes For Napa County Napa county is rank 32nd out of. the process of determining your property taxes involves the efforts of three county offices: Access tax information for any napa county, ca home. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. The median property tax (also known as real estate tax) in napa county. Property Taxes For Napa County.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Property Taxes For Napa County Napa county is rank 32nd out of. to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. napa county (0.70%) has a 1.4% lower property tax than the average of california (0.71%). The county assessor, the county. To view a summary of all current or delinquent fiscal year assessments. Property Taxes For Napa County.

From vineyardandwinerysales.com

Napa and Sonoma County Real Estate market elements, vineyard values Property Taxes For Napa County The county assessor, the county. Access tax information for any napa county, ca home. Napa county is rank 32nd out of. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. the process of determining your property taxes involves the efforts of three county offices: napa county (0.70%) has a 1.4% lower. Property Taxes For Napa County.

From www.bayareamarketreports.com

Napa County Home Prices, Market Conditions Compass Property Taxes For Napa County to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. our napa county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. The county assessor,. Property Taxes For Napa County.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Taxes For Napa County To view a summary of all current or delinquent fiscal year assessments outstanding or paid during. property tax online payments. interested in a napa county, ca property tax search? to access your property tax information, only enter one search criteria in the corresponding row of the chosen field:. The county assessor, the county. Napa county is rank. Property Taxes For Napa County.